Insights & Updates from Annapurna Computers

Learn about TallyPrime, Cloud Accounting, GST, and Digital Transformation for Businesses

Accounting & Tally Knowledge Hub

Explore practical blogs on Tally Prime, GST returns and accounting concepts. Easy explanations designed for students, professionals and business owners.

How to Configure GST in Tally Prime

Learn the complete process of enabling GST in Tally Prime, including company settings, ledgers, tax rates and GST return preparation.

Read Full BlogLatest Practical Blogs

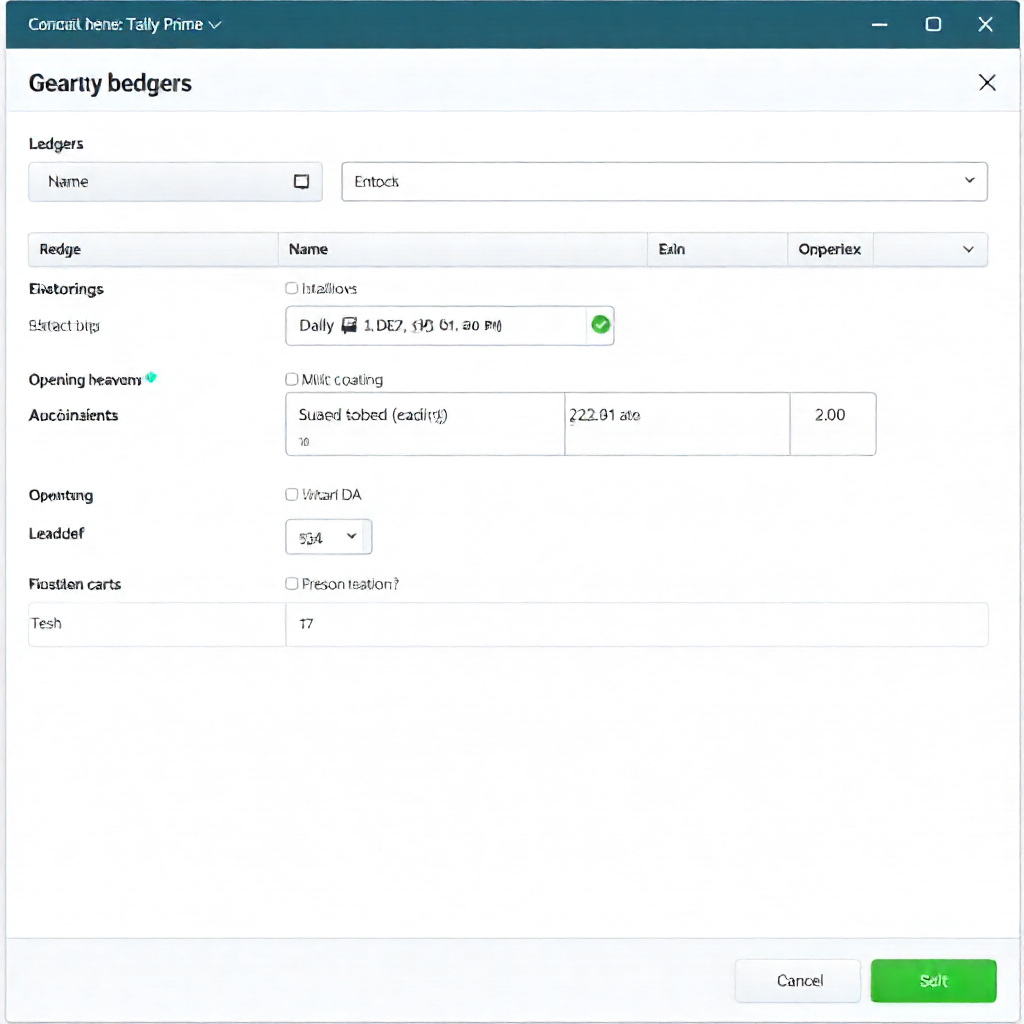

How to Configure GST in Tally Prime

Step 1: Enable GST in Company Features.

Step 2: Create GST Ledgers (CGST, SGST, IGST).

Step 3: Set Tax Rates for Items.

Step 4: Generate GSTR-1 and GSTR-3B.

✅ Common mistakes to avoid: wrong ledger grouping and missing HSN codes.

Company Creation in Tally Prime

Learn how to create a new company in Tally Prime:

- Open Tally and select “Create Company”.

- Set Financial Year and Base Currency.

- Enable features like GST, Inventory, Payroll.

- Save and access the company dashboard.

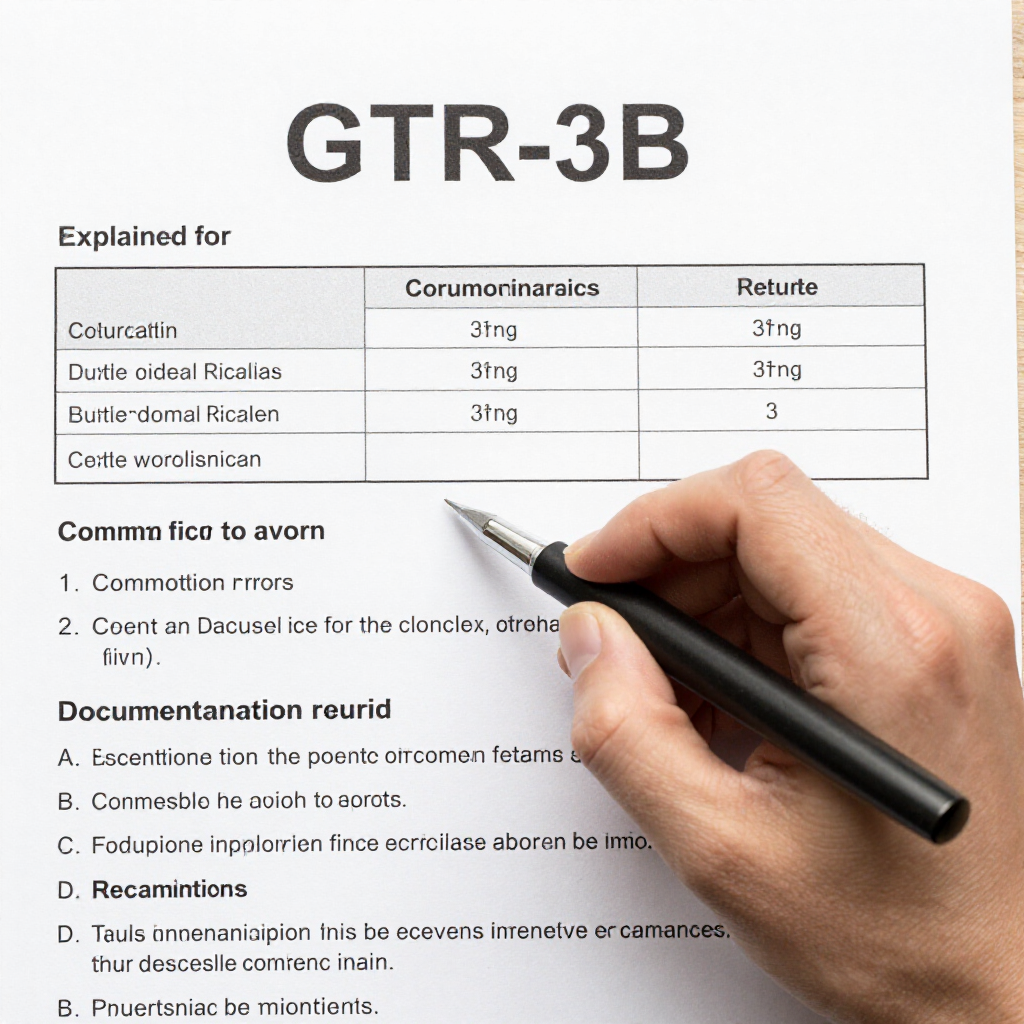

GSTR-3B Return Explained

GSTR-3B is a monthly GST return.

- Tally auto-calculates tax liability.

- Export JSON file for GST portal.

- Avoid common errors like wrong tax rate mapping.

✅ Filing correctly ensures compliance and avoids penalties.

Career Opportunities After Tally Course

After learning Tally, you can work as:

- Accountant

- GST Executive

- Data Entry Operator

- Freelance GST Consultant

🚀 Tally skills open doors to jobs and business opportunities.

Want Hands-On Tally Training?

Join our Tally with GST course and work on real business data.

Join Tally Course

TallyPrime on Cloud: The Future of Accounting

Discover how cloud hosting makes TallyPrime accessible, secure, and cost-effective...

Cloud accounting is the future. With TallyPrime on AWS, businesses can:

- Access TallyPrime from anywhere

- Collaborate across branches in real-time

- Enjoy secure backups and encrypted data

- Pay affordable subscription models

👉 Annapurna Computers helps you set up TallyPrime on Cloud with expert support.

GST Compliance Made Easy with TallyPrime

Simplify GST filing, e-Invoicing, and compliance with TallyPrime’s powerful features...

TallyPrime automates GST filing:

- Auto GST reports

- e-Invoicing & e-Way Bill integration

- Error-free returns

👉 Annapurna Computers ensures your business stays GST-ready with genuine licenses.

Why Choose Annapurna Computers for TallyPrime?

Authorized partner, 500+ clients, free support, and instant WhatsApp help...

We are trusted because:

- Authorized Tally Partner

- 500+ satisfied clients

- Free support & training

- Instant WhatsApp help

👉 Contact us today for genuine Tally licenses and cloud solutions.